- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Peer Supervision for Clinical Hypnotherapists: Peer supervision for clinical hypnotherapists fosters professional growth through enhanced reflective practice, continuous learning, emotional support, feedback and validation, ethical guidance, networking, and professional accountability. - **Enhanced Reflective Practice**: Facilitates self-reflection, helping hypnotherapists identify strengths, weaknesses, and areas for improvement through peer discussions. - **Continuous Learning**: Expands knowledge by sharing innovative techniques, research findings, and emerging trends, promoting ongoing professional development. - **Emotional Support**: Provides a supportive space for therapists to share experiences and receive emotional support, addressing the emotional demands of the profession. - **Feedback and Validation**: Offers constructive criticism and fresh perspectives, aiding in skill refinement and improved clinical practice. - **Ethical Guidance**: Allows discussion of ethical dilemmas and collaborative solutions, ensuring adherence to professional standards. - **Networking and Collaboration**: Builds professional networks, leading to collaboration, referrals, and partnerships. - **Professional Accountability**: Encourages high standards and self-reflection through peer discussions, enhancing practice quality.

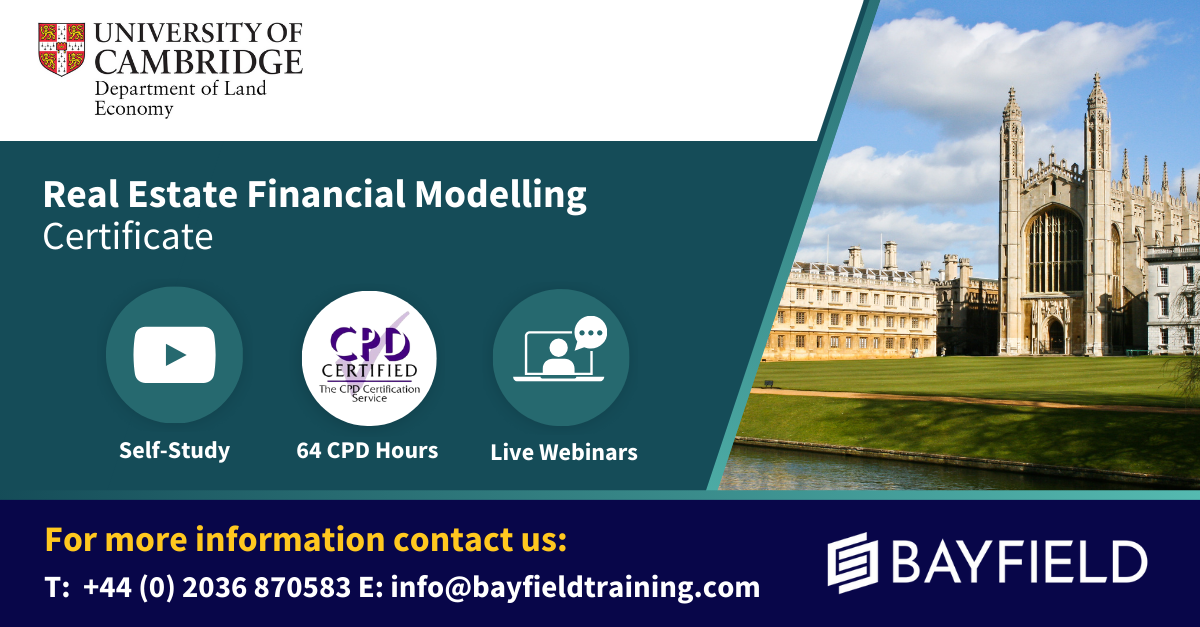

University of Cambridge & Bayfield Training - Real Estate Financial Modelling Certificate (Online Self-Study)

4.3(5)By Bayfield Training

Bayfield Training and the University of Cambridge Department of Land Economy This prestigious eight-week online Real Estate course is suitable for modellers new to Real Estate and experienced Real Estate Analysts looking to formalise their skill set. This course will equip you with skills to start building your own financial models and the certificate will give your employers and colleagues reassurance of your expertise. If you want to enhance your financial modelling skills over an extended period, the Real Estate Financial Modelling Certificate is the course for you. This online real estate course has been put together exclusively for the Real Estate Financial Modelling certificate, using state of the art digital resources such as animations, video-steps, digital whiteboard and video-interactions as well as the spreadsheets, text based resources and tutor contact you would expect from any of Bayfield Training’s classroom based courses. Assessment is in the form of a guided model build exercise and written model appraisal. Participants benefit from an additional months access to the course platform after submission of the assessment. On this course you will: Become a competent model builder, building Real Estate Financial Models from scratch Learn tricks and concepts from financial modelling experts with decades of experience in practice and academia Learn how to use Real Estate Financial Models to make informed investment decisions Learn at a consistent pace over 8 weeks allowing you to take the time to fully grasp this important skill This course is suitable for: Chartered Surveyors Asset Managers Financial Controllers Financial Analysts Investment Managers Property Managers Real Estate Students/Recent Graduates Course Outline: Module 1 - Economic Context Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. Why Real Estate Asset Modelling is important Understanding the occupier, asset and development markets and the relevant modelling approaches for each Real Estate Sub-Sector Key Performance Indicators Introduction to conventional valuations and financial mathematics Understanding and minimising errors in Financial Models Module 2 - Cash Flow Fundamentals Constructing a financial model from first principles. Understanding all the components of a basic cash flow model Understand why Corporate Finance Models and Real Estate Models are different Financial Model Design Making the link between valuations, income mathematics and discounted cash flows Internal Rate of Return, Net Present Value,Worth and other metrics Features and techniques to aid fast model building Module 3 - Developing the Cash Flow Adapting financial models for different periodicities and building rent functions for different rent behaviour. Understanding how leases vary with respect to rent over time: Rent Reviews, Break Clauses, Rent Free Periods, Lease Expiries etc. Developing the concept of a Rent Function in Excel Logic mathematics and Logic functions Projecting rent to adapt to different lease contracts and growth patterns Alternative solutions to Logic functions Comparative analysis of lease structures in different jurisdictions and adapting financial models Module 4 - Real Estate Data Understanding the different sources of data, constructing basic time series models and recognising basic patterns. Key Property market indicators Characteristics and application of key input metrics for Real Estate Appraisals Understanding the eight components of Real Estate Price Dynamics Awareness of the different sources of data Reading and using general property market reports Constructing basic time series models and recognising basic patterns Module 5 - Development Appraisals Constructing a development appraisal from first principles and understanding development return metrics. Understanding the key components of a development project Understanding the difference between development and investment appraisals Residual Appraisals and Profit Calculations Cost orientated cash flows and phased sales Cumulative construction cost patterns: incidental, fixed, loaded and S-curve Development return metrics and Modified IRRs Module 6 - Multi-let Cash Flows Constructing an advanced multi-let cash flow model and learn different techniques to build flexible rent functions. Multi-let and portfolio model design principles Building complex date functions and date series The three multi-let rent projection techniques Perpendicular Rent Functions Incorporate advanced rent adjustments into the Rent Function Incorporate sector and period varying rental growth rates Simplifying OPEX and CAPEX projections Discounting techniques on complex and volatile cash flows Module 7 - Project Finance Constructing a flexible Real Estate Debt Finance model. Revision of the Mathematics of amortisation and debt finance Basic senior debt models and geared net cash flow LTV, IRR and Interest Rate Dynamics Flexible term, repayment options and deferred interest Loan covenant tests Understanding different tranches of debt Understanding how complex debt structures impact the returns to different parties Module 8 - Model Interpretation and Risk Analysis Learn how to read, analyse and report on real estate financial models. Understand how to read models and develop an investment narrative Visualise model outputs using graph functions, conditional formatting, dynamic symbols and dashboards Learn how to use built-in Sensitivity, Scenario Analysis tools and third-party add-ins Learn how to construct varied project scenarios in a systematic way Introduction to Monte Carlo Analysis and VBA Optimising sale dates and other parameters Create well written, attractive and persuasive reports Included in the Course Bayfield Training and University of Cambridge Accredited Certificate & LinkedIn Proficiency Badge 64 CPD Hours 1 Month Post-Course Access to the Digital Platform - 12 Months Post-Course Access to the Platform can be purchased for an additional fee Course Files Q&A Webinars and Guest Speaker Webinars Further Learning Resources (Reading, Files and Videos) Post Course Support - Two Months of Questions & Answers 2024 Cohort Dates Include: 3rd June to 29th July 5th August to 25th September 2024 30th September to 25th November For more information, please contact Sam on the Bayfield Training Sales team: E - s.musgrave@bayfieldtraining.com T - 01223 517851 W - www.bayfieldtraining.com

My Nine Week Energy Healing Journey - An online series of workshops

By Neptune's Daughter Ltd

Join author Thea Faye in this nine week energy healing course. Clear your chakras, raise your vibration and enjoy holistic harmony and wellbeing! Each attendee will receive a FREE accompanying workbook.

MS-721T00 Collaboration Communications Systems Engineer

By Nexus Human

AZ-900T00 Microsoft Azure Fundamentals

By Nexus Human

SC-200T00 Microsoft Security Operations Analyst

By Nexus Human

Specialist Quality Mark (SQM) Standard Training Requirements Course

By DG Legal

This training is designed for lawyers and covers key topics to ensure compliance with the Specialist Quality Mark (SQM) and other regulations.

Creative Practice

By Airtily

Live via Zoom. Fortnightly - 1/15/29 Oct, 12/26 Nov, 10 Dec - 6-8pm UK time Join artist Julie Galante for this course designed to nurture your creative practice. Together we’ll explore ways to create work that reflects your individual interests, passion, and point of view, no matter your experience level. The course content is delivered over six live Zoom sessions, in a small, welcoming group with plenty of opportunities for interaction. Additionally, there will be optional (but highly recommended) assignments to complete in between the live sessions - assignments designed to get you stuck in to your creative practice in new and interesting ways. During each live session, there will be a demonstration focusing on a particular aspect of visual art - this will include various materials, subjects, and considerations such as composition, theme, mark-making, layering, and so on. We will also have a look at everyone’s recent creations, with celebration of the triumphs and suggestions for moving forward with work-in-progress. Together we’ll explore techniques including drawing, painting, mixed-media, and collage, but you don’t have to work exclusively in these media to take part - all creative disciplines are welcome. Each participant will be encouraged to deepen their explorations in whatever direction interests them most - be it a series of drawings, written reflections, sketches, collages, photographs, mixed-media pieces, or a unique, personal combination of all these. There will be an optional Facebook group for participants to stay connected and share their creations with each other between sessions. There will also be discounts available for other workshops and one-to-one mentoring.

Are you looking to enter the dynamic world of real estate? Our course is designed to equip you with the knowledge and tools you need to communicate effectively with real estate professionals and develop key skills in real estate investment strategy and analytics. At the end of the course, you'll be able to read and interpret real estate market reports, and have a firm grasp of how iconic buildings, cities, and companies fit into the overall picture of the real estate sector. On this course, you will… Become familiar with the players, structure, general terminology and overall needs of Real Estate. Learn what is Real Estate and why it is different from other asset classes Get to grips with the overall size and structure of the UK Real Estate Market Learn and analyse the links between the different parts of the property market Understand who works in the Real Estate Market, their qualifications and their job descriptions Recognise how and when to use basic real estate concepts: Rent, Value, Yield, Risk and Return, etc… Learn how to read a real estate market report Understand how current affairs, politics and economics affects Real Estate Investment Use household names and iconic companies, cities and buildings to help consolidate your appreciation of this exciting sector Who will benefit from this course: Graduates or undergraduates studying economics, finance. Professionals working in Marketing or Accounting teams within Real Estate firms. APC students. Anyone interested in Real Estate. School leavers/A-Level Students looking to gain an understanding of Real Estate. Non cognate students who wish to transfer into Real Estate/Finance careers. Course Outline Module 1: What is and why buy Real Estate? The property Market The Size and Structure of the UK property market The impact of Real Estate in the Economy Module 2: The Real Estate Market System The Space Market The Asset Market The Development Market Module 3: How to value Real Estate An Introduction to Financial Mathematics The difference between Price, Value and Worth Property Yield Conventional Valuation Methods Module 4: How to read a Real Estate Market Report Property Market Indicators: Stock Indicators Property Market Indicators: Investment Indicators Module 5: Who works in Real Estate? The build Environment by Cobalt Recruitment Rea; Estate Agents Examples of Real Estate Market Agents CVs Real Estate Network