97 Financial Services Compliance courses

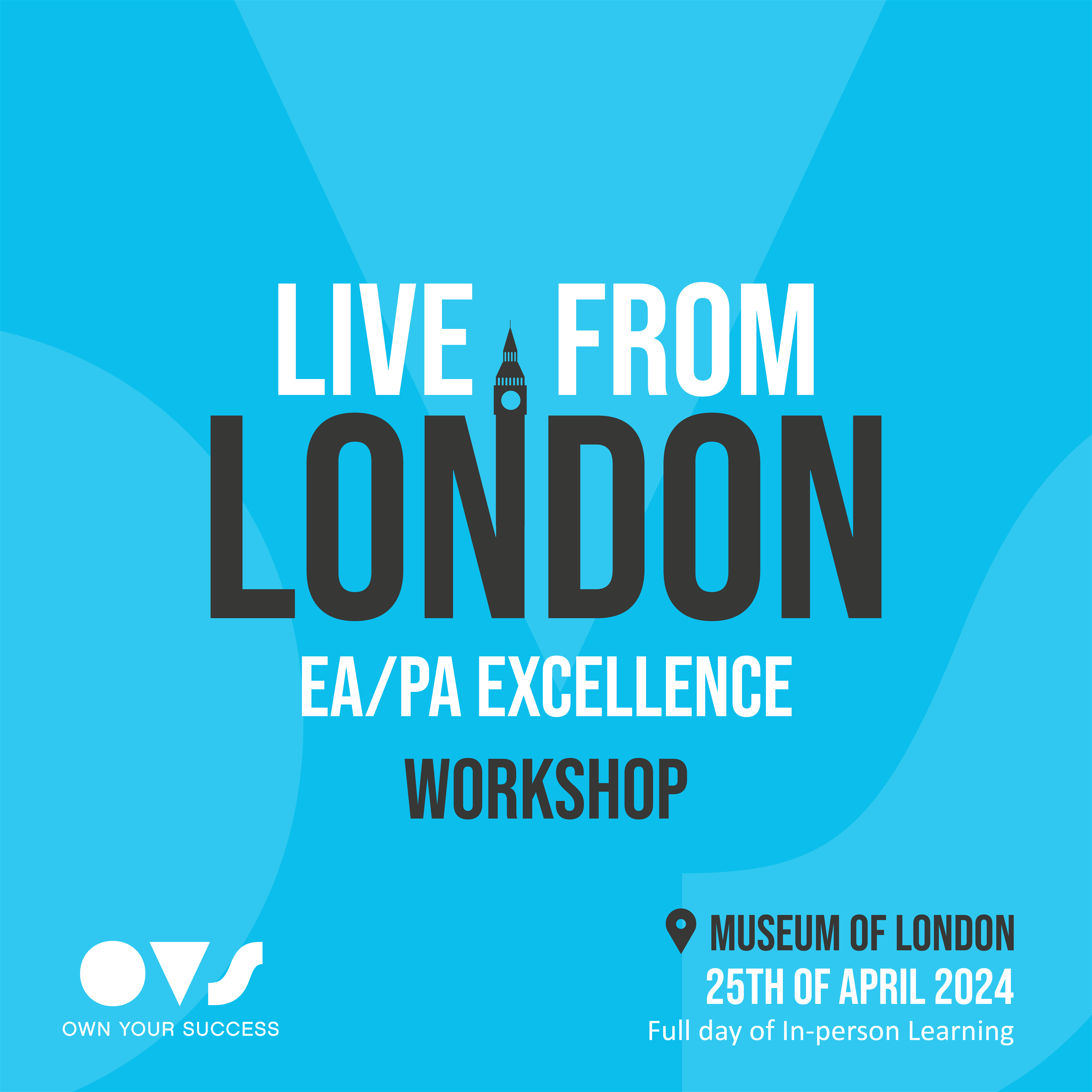

EA/PA Excellence Workshop Live from London on the 25th of April 2024. Featuring Keynote speaker Reggie Love, former Special Assistant to 44th President of the USA, Barrack Obama. Panel featuring Sophie Chapman, assistant to Steven Bartlett entrepreneur, author, host of the diary of a CEO and youngest ever dragon on BBC's Dragon's Den, Victoria Wratten, CEO of the Executive & Personal Assistants Association. The workshop contains, panel talk, keynote talk and facilitation over key topics from Kate Wood over the course of the day.

Women in Banking Leadership Workshop Workshop Overview: Unleash your potential - The Banking and Financial Services industry is a constantly changing sphere that calls for emerging leaders to adapt and grow in order to thrive and succeed. Often those wanting to take the next step in the field find it hard to see their full value and potential, slowing their progress in a world full of opportunities. Emerging leaders will need to understand their professional values and know how to cultivate a growth mindset to stand out and fulfil their career desires. This interactive virtual workshop will provide emerging leaders within the field the skills to understand the strengths that they are able to bring to the corporate table to confidently unleash their potential. It will particularly benefit those who aspire to move beyond early management to broader leadership roles. Kat will guide attendees to unlock their potential through releasing self-doubt, connecting to their unique contribution and forming a confident, strategic leader that will drive an organisation to success. -------------------------------------------------------------------------------- Our Aims for the Workshop: * Navigate key challenges and change in fast-paced work-places * Understand the value of embracing complexity, uncertainty and diversity * Negotiate diversity and inclusion biases, enablers and blocker -------------------------------------------------------------------------------- Topic 1 Define your leadership style * What are the capabilities, attributes and skills of an influential leader? * What is your unique contribution? Is this congruent with your personal brand? * Align your leadership strengths and values with the expectations and culture of your organisation. Topic 2 Leading with Emotional Intelligence (EQ) * Understand your EQ and its impact on the way you are perceived as a leader * Leverage your EQ in the workplace both in person and online * Embrace qualities of empathy and authenticity to become a better leader Topic 3 Interactive Panel Q&A Discussion: * Open Q&A with Senior Female leaders within the banking sector. * Please see below the panel and biographies of each panellist. Topic 4 How to be known as a strategic leader * Understand the uplevel from management to leadership and how to articulate your strategy * How to translate broad leadership tools and tactics into practical, personalised results * Move from transactional to transformational leadership Topic 5 Strengthen your resilience and resolve * What is stress and how do you “show-up” on a bad day? * Bounce back from challenging situations and predicaments * Effectively manage conflict and turn negativity into an opportunity -------------------------------------------------------------------------------- Who will attend? * Emerging Leaders looking to step into management roles * Current Leaders looking to progress into senior management roles This workshop is open to any woman who works in the banking sector that wants to take her next step in their career; women include trans women and non-binary people who are comfortable in a female-centred group. -------------------------------------------------------------------------------- Group Rate Discounts 2-3 people, 7% discount 4+ people, 20% discount We have two group rates which you can take advantage of depending on the size of the group you wish to book: Option 1️⃣ Groups between 2 & 3 are eligible for the 7% Discount. Please use this code at checkout: GROUP 2+ Option 2️⃣ For groups of over 4+ attendees, the eligible discount is 20%. Please use this code at checkout: GROUP 4+ Where do I add the discount code? -------------------------------------------------------------------------------- Your Facilitator Kat HutchingsKat coaches Executives and senior leaders in scale businesses to develop their leadership capability, build high-performing teams and create a culture that motivates and delivers. She works with them to identify their unique contribution and lead in a way that's aligned with who they are. Clients that work with Kat connect to their sense of purpose and how they contribute to the organisation. This creates a ripple effect through their team as they step into more powerful and impactful leadership. Kat coaches for insight - because a single insight can inspire action that changes everything. Client outcomes include improved sales performance, successful delivery of change & transformation programmes and greater employee engagement & wellbeing. Kat is an accredited Professional Executive Coach with the Association for Coaching and a Master NLP Practitioner. She has studied neuroscience, mindfulness and resilience, often bringing these insights to her coaching and training. Combined with her experience as a leader in Financial Services, Kat’s clients find her to be commercially minded, knowledgeable and positively challenging. Her background as a corporate banker means Kat is quickly able to understand the context, including a firm’s strategy, vision and drivers. As a former Head of Coaching for the London & South East region of a FTSE 100 organisation, Kat is also well versed in leadership development programmes – their design, delivery and embedding through coaching. Outside of her coaching work, Kat spends lots of time with her husband and 2 young children. She enjoys trying different wines, talking to interesting people, having new experiences and buying flowers. -------------------------------------------------------------------------------- THE PANEL The final panel is coming soon ⏳

In this course, you will explore the core principles of risk and risk management in the context of the financial services sector. This training programme will cover a wide range of topics, from the regulatory environment and risk identification to the three lines of defence model and the impact of risk on the broader business environment. By the end of this course, you’ll be equipped with the knowledge and skills necessary to navigate the complex world of financial risk management. This training programme will guide you through the intricacies of the financial services industry, providing real-world examples and practical insights. The course features a structured approach with end-of-chapter questions to test your understanding, ensuring that you’re well-prepared to tackle risk management challenges. Join us on this educational journey to enhance your understanding of risk management in financial services and to develop the expertise needed to thrive in this dynamic industry! -------------------------------------------------------------------------------- Study method Online, self-paced Course format What's this? Reading material - PDF/e-book, article/plain text Duration 30 hours Access to content 90 days Certification Certificate in Risk Management Certificates Qualification Certificate - Free -------------------------------------------------------------------------------- DESCRIPTION The AGRC Certificate in Risk Management is a comprehensive programme aimed at providing participants with a deep understanding of risk and risk management within the financial services sector. This course covers a wide array of topics, including the regulatory environment, risk identification, and the three lines of defence model. By the end of the program, participants will be equipped with the knowledge and practical skills required to navigate the intricacies of financial risk management. Whether you’re a student, professional, or simply interested in financial risk management, this course offers a solid foundation in this critical field. The expected learning outcomes encompass an array of skills, from understanding risk principles to conducting risk assessments and applying risk management frameworks in practical scenarios. This program is a valuable educational journey for those seeking to excel in the dynamic world of financial services. Some of the topics to be covered by this Certificate include: * Principles of Risk and Risk Management * The Financial Services Sector * Impact of Risk in Financial Services * The Regulatory Environment in Financial Services * Establishing and Applying a Risk Management Framework * Approaches Used to Identify, Assess, and Treat Risks * The Three Lines of Defence Model * Sources of Risk in Financial Services * Risk Assessments in Financial Services * Risk Treatment and Incident Response WHO IS THIS COURSE FOR? This course is ideal for anyone wishing to be introduced to risk management in the financial services industry. Professionals carrying out the roles of directors, members of the Board, senior managers, lawyers, company secretaries, compliance and risk officers, and consultants may benefit from this course. It is also suitable to professionals pursuing regulatory CPDs in financial regulation. REQUIREMENTS No previous knowledge or experience is required, although it is assumed that participants have good knowledge of English and a sound educational background.

In this course, you will explore the core principles of risk and risk management in the context of the financial services sector. This training programme will cover a wide range of topics, from the regulatory environment and risk identification to the three lines of defence model and the impact of risk on the broader business environment. By the end of this course, you’ll be equipped with the knowledge and skills necessary to navigate the complex world of financial risk management. This training programme will guide you through the intricacies of the financial services industry, providing real-world examples and practical insights. The course features a structured approach with end-of-chapter questions to test your understanding, ensuring that you’re well-prepared to tackle risk management challenges. Join us on this educational journey to enhance your understanding of risk management in financial services and to develop the expertise needed to thrive in this dynamic industry! -------------------------------------------------------------------------------- Study method Online, self-paced Course format What's this? Reading material - PDF/e-book, slides, article/plain text Duration 15 hours Access to content 365 days Certification AGRC Certificate in ESG Principles and Standards -------------------------------------------------------------------------------- OVERVIEW During the past several years, ESG has gained plenty of prominence throughout the corporate world as a growing number of organisations have started embracing its three pillars and setting up programmes targeting issues such as climate change, diversity, equity and inclusion, employee benefits, executive bonus structures, and more. Pressure from stakeholders, the upcoming generation of professionals and consumers, and society at large have made it a crucial part of any organisation’s strategy to look after their activities and performance in these areas. In many cases, these organisations’ growth, stability, and continuity as businesses are at stake. As part of this programme, you will pick up the ins and outs of ESG from a compliance and reporting perspective and be better prepared to help your organisation develop a sound, effective, and long-term strategy to tackle all ESG issues. CERTIFICATION AGRC CERTIFICATE IN ESG PRINCIPLES AND STANDARDS Awarded by Association of Governance, Risk and Compliance DESCRIPTION The AGRC Certificate in ESG Principles and Standards provides participants with a thorough understanding of a topic that has gained increasing significance and attention amongst corporations, regulators, and researchers. At the same, the Certificate offers guidance as to how corporations can best prepare under the growing number of ESG-related regulations. Topics to be covered by this certificate include: * The Stakeholder Theory * Corporate Social Responsibility (CSR) vs. ESG * Sustainability * The Environment, Social and Governance Pillars * Green Finance * Principles of Responsible Banking, Investment, and Insurance * The Business Case for CSR, ESG, and Sustainability * Global Initiatives and Development such as The Paris Agreement, the European Green Deal, and the UK’s Green Finance Strategy * ESG Reporting Standards and Frameworks * ESG Investing Strategies * The Push for ESG into the Future By acquiring the Certificate, participants will be able to: * Define the three ESG pillars—Environment, Social and Governance. * Identify the importance of ESG and CSR programmes to an organisation’s corporate governance practices. * Understand the main concepts behind Green Finance and how responsible banking, investment, and insurance work within this framework. * Describe the objectives and main tenets of the many global initiatives set up to encourage policies that will contribute to the growth and advancement of ESG issues. * Study the main ESG reporting standards and frameworks so that your organisation is better prepared to fulfil its reporting requirements. * Understand the main concepts behind ESG investing. WHO IS THIS COURSE FOR? This course is ideal for anyone wishing to be introduced to ESG and the different requirements that this sector might entail moving forward. Professionals carrying out the roles of directors, members of the Board, senior managers, lawyers, company secretaries, compliance and risk officers, and consultants may benefit from this course. REQUIREMENTS No previous knowledge or experience is required, although it is assumed that participants have good knowledge of English and a sound educational background.

Here’s your starting point to a rewarding and successful career in compliance! Learn the ins and outs of compliance for the financial services industry with LGCA and become a certified professional member of the fastest growing GRC association out there. Every organization faces a myriad of risks that can threaten its operations, reputation, and bottom line. A robust, effective compliance program can make the difference between companies that successfully navigate those risks, and those that become cautionary tales. Faced with increasingly regulated environment, this programme offers insight into good compliance practices and the skills to lead effective compliance programmes that supports ethical conduct and commitment to compliance. -------------------------------------------------------------------------------- Study method Online, self-paced Duration 25 hours Access to content 360 days Certification Certificate in Compliance Additional info Exam(s) / assessment(s) is included in price -------------------------------------------------------------------------------- DESCRIPTION This certificate programme will introduce the essential elements of effective organizational compliance by exploring the concepts, considerations, and strategies for assessing risks and managing the compliance function. You will learn the fundamental principles of effective compliance, the components of an effective compliance program and their applications. In addition, you will explore the foundational principles of compliance: what are the sources of compliance requirements; where are the requirements found; what behavior satisfies “compliance;” and how do compliance personnel motivate compliant behavior throughout their organization. Expected Learning Outcomes By acquiring the Certificate, participants are expected to be able to: • Comprehend and maintain awareness of compliance requirements • Organise and monitor the operation of compliance management system • Implement processes for the management of breaches in compliance requirements • Provide education and training on compliance requirements and systems • Promote and liaise on compliance requirements, systems and related issues • Promote compliance with a sound understanding of the requisite legislation • Show leadership in the workplace • Identify risk and apply risk management processes • Manage projects • Undertake compliance audits Certificate Content Compliance • Compliance Programs • Compliance Perspectives • Why do we Need Compliance? International Regulatory Landscape • Key Elements • Principle based Vs Rules Based Approach • Market Forces • Regulation and Practice Compliance in Practice • The role of the Compliance department • The role of the Compliance Officer • The role of the Board • Key compliance activities and processes • Key compliance relationships Ethics, Compliance and Governance Perspectives • Ethics • Compliance • Governance Other Key Compliance Areas • Anti-money laundering • Financial crime prevention • Managing risk • Enforcement Certificate Format • Register at any time for this online, open certificate • Study in your own time and at your own pace (you have up to 3 months to complete the certificate) • Assessed by online multiple-choice exam Exam Format • Type: Multiple choice, closed book online exam • Duration: Two hours • Pass mark: 70% • Number of questions: 100 What is included • 25 hours of self-paced online interactive learning including analysis of 4 practical case studies • 1-year free AGRC membership • Practice Questions • Online Exam and AGRC Certificate WHO IS THIS COURSE FOR? Staff working in or aspiring to work in the compliance area * New graduates from any discipline * Staff involved in risk functions and internal or external audit * Those wanting to build a career in compliance in the fields of: Banking – Insurance – Other financial services REQUIREMENTS No previous knowledge or experience is required though it is assumed that participants have good knowledge of English and sound educational background. CAREER PATH Compliance Officer, Head of Compliance, Compliance Director

Certificate in Compliance

By The Association of Governance, Risk & Compliance

Here’s your starting point to a rewarding and successful career in compliance! Learn the ins and outs of compliance for the financial services industry with LGCA and become a certified professional member of the fastest growing GRC association out there.

In this day and age, it’s crucial to know everything there is to know about international economic sanctions. With AGRC’s Certificate in Sanctions Compliance, you will acquire the theoretical and practical knowledge and skills to comply with any sanction imposed and protect your business from penalties and reputational damage. Over the past several decades, international economic sanctions have become a central instrument in global governance, being employed by both sovereign states and international organisations. More recently, there has been a shift towards ‘smart’ or targeted sanctions that aim at the political and economic elites of targeted countries (e.g., through asset freezes and travel bans) rather than a more comprehensive sanctions approach (e.g., large-scale trade or oil embargoes) that has a detrimental effect on civilian populations. In the era of financial globalisation, such ‘smart’ sanctions entail increased compliance obligations for state institutions and private organisations which, if not met, carry significant fines, penalties, and other adverse consequences. -------------------------------------------------------------------------------- Study method Online, self-paced Duration 25 hours Access to content 365 days Certification Certificate in Compliance Additional info Exam(s) / assessment(s) is included in price -------------------------------------------------------------------------------- DESCRIPTION This certificate provides a thorough understanding of sanctions and an opportunity to explore the recent global trends in economic sanctioning, while tracing the roles of the relevant actors within this complex framework. You will examine the motives and rationale behind such decisions, the effects and consequences experienced not only by the targeted parties but also those doing business with them, either directly or indirectly. The certificate is structured to offer the relevant knowledge with reference to practical examples that will enable for a sanctions compliance strategy to be conducted in an effective manner, essential to mitigating the sanctions risk. Topics Covered • Definition of sanctions • Framework and legal basis • The international framework • Multilateral sanctions • Unilateral sanctions and key sovereign states • The legal and institutional framework • Categories of restrictive measures • Administration of sanctions • Managing and mitigating sanctions risk • Sanctions compliance programmes • Processes and systems • Sanctions screening and evasion Expected Learning Outcomes Upon completing this certification, you will be able to: • Understand sanctions and the importance of compliance • Understand why it’s important to comply • Review and understand the global sanctions framework • Define a sanctions compliance programme and governance framework • Define sanctions lists and screening • Manage alert investigations • Understand sanctions risk • Determine how much your institution is vulnerable to sanctions risks • Apply modern methodologies that will increase the efficiency and effectiveness of your programme • Protect your institution from dealing with embargoed individuals or entities • Understand the best practices for sanctions compliance controls WHO IS THIS COURSE FOR? * Financial crime and regulatory compliance professionals * Professionals working within the sanctions environment who wish to certify their knowledge * Operational staff who need to understand the importance of sanctions compliance * Regulators * Consultants * AML, compliance, and risk professionals * Anyone working in financial services interested in attaining a better understanding of how sanctions work REQUIREMENTS No previous knowledge or experience is required, although it is assumed that participants have good knowledge of English and sound educational background.

Become a financial crime prevention superhero with LGCA’s help! Pick up everything you need to know to join a company’s AML function and start fighting crime with your newfound knowledge and skills. The Certificate in AML provides participants with a thorough understanding of what constitutes Money Laundering (ML) and how financial institutions should respond to increasingly complex attempts by criminal individuals and entities to process proceedings from illegal activities in a manner that enables them to enjoy such illegal proceedings. -------------------------------------------------------------------------------- Study method Online, self-paced Duration 25 hours Access to content 360 days Certification Certificate in Anti Money Laundering (AML) Additional info Exam(s) / assessment(s) is included in price -------------------------------------------------------------------------------- DESCRIPTION About the Certificate Participants will investigate what is ML, what constitutes a risk-based approach in dealing with ML and the relevant policies and procedures that may be adopted by a financial institution as part of a coherent AML Strategy. In addition, participants will be provided with an overall assessment of international economic sanctions and how these are valuable tools in combating ML. The Certificate also offers participants, a practical perspective of how AML attempts have been formally incorporated and have led to the creation of legal frameworks that aim to prevent ML practices. The knowledge obtained by undertaking this Certificate is an invaluable asset for professionals that seek to enhance their career prospects in AML which is becoming an increasingly significant issue for financial institutions. Topics covered • Money laundering methods, techniques, red flags, key risk areas and compliance best practices & checklists • KYC and CDD: Beneficial ownership, money laundering risks in gatekeeper roles, politically exposed persons, and much more • Economic Sanctions and relevant frameworks • Vulnerabilities of Financial Institutions • Legal Framework for AML – A practical perspective • Case Studies and analysis Expected Learning Outcomes • Identify ML-related risks and dangers that need to be dealt with through a rigid AML strategy • Understand ML risk assessment and management and learn how to design a comprehensive AML risk-based approach • Review the relevant processes and procedures that need to be adopted as part of an AML strategy • Gain a practical perspective through a review of the relevant legal framework that covers AML • Understand the importance of sanctions and how these can be utilised as a tool to combat ML Format • Register at any time • Study in your own time and at your own pace (you have up to 3 months to complete the Certificate) • Assessed by an online multiple-choice exam What is included • 25 hours of self-paced online interactive learning including analysis of 5 practical case studies • 1-year free AGRC membership • Online Exam and AGRC Certificate Completion Requirements • Success in all the unit tests. Each unit is allocated two, three or four Multiple Choice questions (MCQs). In total 33 MCQs with a pass mark of 70% and an unlimited number of attempts. Each unit test is 10 minutes. • Success in the final test of 40 MCQs for the completion and award of the Certificate in Anti Money Laundering, issued by the Association of Governance, Risk and Compliance (AGRC). The pass mark is 70% and two attempts are permitted. The final test is 60 minutes. WHO IS THIS COURSE FOR? Individuals who aspire to a career in AML, staff with specific anti-money laundering duties and staff working in financial services who want a comprehensive training in AML. No previous knowledge or experience is required although it is assumed that participants have good knowledge of English and a sound education background. REQUIREMENTS No previous knowledge or experience is required though it is assumed that participants have good knowledge of English and sound educational background. CAREER PATH AML Officer, MLRO, Head of Back Office, Compliance Officer, Risk Manager, Manager, Director

Whether you’re a board member or just curious about corporate governance, this AGRC certificate is for you! Learn what it takes for any firm to build and maintain a robust, dependable, and responsible corporate governance backbone with this self-paced, online certificate delivered by LGCA. The concept of corporate governance has featured regularly in discussions, both within the professional and academic community, since the 1990s and has become even more prominent following significant cases of corporate failure that had adverse effects on the global interconnected economy. Additionally, the Certificate places emphasis on how internal control mechanisms need to be designed and underlines how helpful the three lines of defence model may be. The certificate also covers the importance of maintaining strong and productive relations within the Board, ones that are based on trust and which allow for effective meetings and interaction to be achieved. Lastly, emphasis is placed on the modern concepts of Corporate Social Responsibility (CSR), Environmental Social Governance (ESG), and Sustainability, and how the Board needs to respond to these trends as they gain increased relevance and importance for the corporate world. Overall, the knowledge obtained by undertaking this Certificate is an invaluable asset for professionals looking to enhance their career prospects in Corporate Governance. The link between poor corporate governance practices and the excessive taking of risks that led to the downfall or bail-out of important financial institutions necessitated a discussion on how to strengthen corporate governance and protect the economy against similar cases in the future. Effectively, new regulatory requirements have been established, while existing codes of governance have been revised. Such efforts aim to focus on requirements that should be fulfilled by an organisation’s management body and enhance three areas of governance: remuneration, risk management, and internal control. In this programme, participants will review key definitions of corporate governance and the benefits associated with the implementation of good corporate governance practices. More specifically, participants will look in greater detail at the Board of Directors, covering the duties and responsibilities of Directors, the composition of the Board, the role of key post-holders, the many Board committees and how they are structured, and how a Board’s performance can be evaluated. -------------------------------------------------------------------------------- Study method Online, self-paced Course format What's this? Reading material - PDF/e-book, slides, article/plain text Duration 15 hours Access to content 365 days Certification Certificate in Corporate Governance CPD 15 CPD hours / points Certificates AGRC Certificate in Corporate Governance - Free Additional info Exam(s) / assessment(s) is included in price -------------------------------------------------------------------------------- DESCRIPTION The AGRC Certificate in Corporate Governance provides participants with a thorough understanding of a topic that has gained increasing significance and attention amongst corporations, regulators, and researchers. At the same, the Certificate offers guidance as to how corporations can best prepare in creating solid governance structures that will help them deal with the myriad of modern-day corporate challenges and risks. Syllabus: Introduction to Corporate Governance * Definition of Corporate Governance * Ethics and Governance * Key Relevant Governance Theories * Agency Theory * Stakeholder Theory The Benefits of Corporate Governance * Board of Directors * Duties and Responsibilities of Directors * Specific Requirements for Financial Institutions * Board Appointments and Composition * Independent and Non-Executive Directors (INEDs) * The Importance of Diversity in a Board * Committee Structure * Board Committees * Committee Structure * Audit Committee * Risk Committee * Nominations Committee * Remuneration Committees * Key Post-Holders in a Board * Chair of the Board * Senior Independent Director (SID) * CEO (Ex-Officio Board Member) * Evaluation & Continuous Development * Knowledge of Industry and OrganisationInternal Control Mechanisms * Internal Controls and Risk Management * Three-Lines of Defence model Intra-Board Relations * Effective Meetings CSR, ESG and Sustainability * Definitions of Relevant Terms * Corporate Social Responsibility (CSR) * Environmental Social Governance (ESG) * Sustainability * The Business Case for CSR, ESG, and Sustainability * ESG, Sustainability, and the Role of the Board Format • Register at any time for this online, open Certificate • Study in your own time and at your own pace (you have up to 3 months to complete) • Assessed by online multiple-choice exam What is included • 15 hours of self-paced online interactive learning including analysis of 7 practical case studies • 1-year free AGRC membership • Online Exam and AGRC Certificate WHO IS THIS COURSE FOR? This course is ideal for anyone wishing to be introduced to the main regulatory provisions in financial services and trends in corporate governance. Professionals carrying out the roles of directors, members of the Board, senior managers, lawyers, company secretaries, compliance and risk officers, and consultants may benefit from this course. It is also suitable for professionals pursuing regulatory CPDs in financial regulation. REQUIREMENTS No previous knowledge or experience is required, although it is assumed that participants have good knowledge of English and sound educational background. CERTIFICATES AGRC CERTIFICATE IN CORPORATE GOVERNANCE Digital certificate - Included The certificate is issued upon successful passing of the final exam.

Join our Women in Insurance Leadership Workshop and gain insights from industry experts on how to succeed in the male-dominated insurance sector. This workshop is designed to empower women by providing valuable tools and resources to enhance leadership skills, build professional networks, and create a more inclusive workplace culture. Don't miss this opportunity to connect with other women in the industry and take your career to the next level. Register today!

Search By Location

- Financial Services Compliance Courses in London

- Financial Services Compliance Courses in Birmingham

- Financial Services Compliance Courses in Glasgow

- Financial Services Compliance Courses in Liverpool

- Financial Services Compliance Courses in Bristol

- Financial Services Compliance Courses in Manchester

- Financial Services Compliance Courses in Sheffield

- Financial Services Compliance Courses in Leeds

- Financial Services Compliance Courses in Edinburgh

- Financial Services Compliance Courses in Leicester

- Financial Services Compliance Courses in Coventry

- Financial Services Compliance Courses in Bradford

- Financial Services Compliance Courses in Cardiff

- Financial Services Compliance Courses in Belfast

- Financial Services Compliance Courses in Nottingham