230 Financial Reporting courses

Get a 10% discount on your first order when you use this promo code at checkout: MAY24BAN3X

The Managing Budget: Financial Statements and Money Management course provides comprehensive knowledge of budgeting fundamentals, financial statements, and budget monitoring. Participants will learn to create, manage, and analyze budgets, gaining valuable insights into financial decision-making processes and investment opportunities. LEARNING OUTCOMES: 1. Understand the fundamentals of finance and budgeting principles. 2. Identify the components and structure of financial statements. 3. Master the budgeting process, including budget creation and approval. 4. Acquire budgeting tips and tricks for efficient money management. 5. Learn techniques for monitoring and managing budgets effectively. 6. Develop the skills to crunch numbers and analyze financial data. 7. Compare and evaluate investment opportunities for decision-making. 8. Gain knowledge of ISO 9001:2008 quality management standards. WHY BUY THIS MANAGING BUDGET: FINANCIAL STATEMENTS AND MONEY MANAGEMENT? 1. Unlimited access to the course for forever 2. Digital Certificate, Transcript, student ID all included in the price 3. Absolutely no hidden fees 4. Directly receive CPD accredited qualifications after course completion 5. Receive one to one assistance on every weekday from professionals 6. Immediately receive the PDF certificate after passing 7. Receive the original copies of your certificate and transcript on the next working day 8. Easily learn the skills and knowledge from the comfort of your home CERTIFICATION After studying the course materials of the Managing Budget: Financial Statements and Money Management there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. WHO IS THIS COURSE FOR? * Aspiring finance professionals looking to enhance their budgeting skills. * Managers and team leaders involved in financial decision-making. * Small business owners seeking to improve their money management abilities. * Professionals in non-financial roles aiming to understand budgeting and financial statements. PREREQUISITES This Managing Budget: Financial Statements and Money Management does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Managing Budget: Financial Statements and Money Management was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. CAREER PATH * Financial Analyst: Analyze financial data and provide insights to support decision-making. * Budget Analyst: Create, manage, and review budgets for organizations. * Financial Manager: Oversee financial operations and develop long-term financial strategies. * Business Consultant: Advise clients on financial management, budgeting, and investment. * Entrepreneur: Apply budgeting skills to manage financial resources and optimize profitability. COURSE CURRICULUM Budgets and Financial Reports Module One - Getting Started 00:15:00 Module Two - Glossary 00:30:00 Module Three - Understanding Financial Statements 00:30:00 Module Four - Analyzing Financial Statements (I) 01:00:00 Module Five - Analyzing Financial Statements (II) 00:30:00 Module Six - Understanding Budgets 00:30:00 Module Seven - Budgeting Made Easy 00:30:00 Module Eight - Advanced Forecasting Techniques 00:30:00 Module Nine - Managing the Budget 00:30:00 Module Ten - Making Smart Purchasing Decisions 01:00:00 Module Eleven - A Glimpse into the Legal World 01:00:00 Module Twelve - Wrapping Up 00:15:00 Budgets and Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00 Recommended Reading Recommended Reading : Finance and Budgeting Diploma 00:00:00 Assignment Assignment - Managing Budget: Financial Statements and Money Management 00:00:00

Reporting and Data

By Apex Learning

OVERVIEW This comprehensive course on Reporting and Data will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Reporting and Data comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. HOW WILL I GET MY CERTIFICATE? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. WHO IS THIS COURSE FOR? There is no experience or previous qualifications required for enrolment on this Reporting and Data. It is available to all students, of all academic backgrounds. REQUIREMENTS Our Reporting and Data is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. CAREER PATH Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- * Open doors of opportunities * Increase your adaptability * Keep you relevant * Boost confidence And much more! COURSE CURRICULUM 6 sections • 16 lectures • 01:13:00 total length •Introduction: 00:05:00 •The fundamentals of Organisational Reporting: 00:17:00 •Current State: 00:03:00 •Review Data: 00:03:00 •Define Requirements: 00:03:00 •Survey key Stakeholders: 00:04:00 •Gap analysis: 00:03:00 •Build the First Report: 00:04:00 •Get feedback: 00:03:00 •Amend the Reporting: 00:04:00 •Roll out: 00:04:00 •Continuously Improve: 00:03:00 •Overview of Process: 00:02:00 •Case Study: 00:08:00 •Close Out: 00:07:00 •Assignment - Reporting and Data: 00:00:00

Accounting and Finance (Financial Planning & Financial Analysis)

By NextGen Learning

Are you an entrepreneur? Does accounting feel too complicated? Do financial reports and numbers confuse you? Do You Want to Learn Accounting and Finance in a Fun and Simple Way? Then stop your search. This is the best course for you in accounting and finance! Immerse yourself in the world of "Accounting and Finance (Financial Planning and Financial Analysis)," a transformative course that unravels the intricacies of financial management. Delve into fundamental principles, explore the roles of accountants, and navigate through industry standards. From mastering transaction recording to deciphering financial statements, you'll gain essential skills in analysing a company's fiscal health. Your career growth is our priority. Our tailored Accounting and Finance course, developed with expert insights, enhances your skills for today's competitive landscape. This streamlined Accounting and Finance programme offers exclusive training, ensuring relevance and readiness for career advancement. Master the latest materials, equip yourself for success, and elevate your organisation with our Accounting and Finance Programme." So, if you are eager to see yourself in a gratifying career, enrol in our Accounting and Finance course today! What will make you stand out? On completion of this online Accounting and finance course, you will gain the following: * QLS Endorsed Training * CPD QS Accredited Accounting and Finance Course. * Lifetime access to the whole collection of learning materials. * The online test with immediate results * You can study and complete the Accounting and Finance course independently. * Study for the Accounting and Finance course using any internet-connected device, such as a computer, tablet, or mobile device. Accounting and Finance (Financial Planning & Financial Analysis)" is a specially crafted course to deepen your understanding of accounting and finance. The curriculum delivers comprehensive insights into accounting fundamentals, the responsibilities of accountants, and universally accepted accounting principles and standards. The accounting and Finance course navigates vital financial aspects such as recording transactions, interpreting balance sheets, income and various financial statements, and cash flow management. Additionally, it elucidates the concepts of profitability, financial budgeting, planning and auditing. This educational journey provides a robust foundation for your accounting and finance career, enabling you to excel in financial budgeting and planning. Become a master of accounting and finance with this comprehensive course. Enrol in our Accounting and Finance course now to shape a thriving career and drive organisational success. Quality Licence Scheme Endorsed Certificate of Achievement: Upon successful completion of the course, you will be eligible to order an original hardcopy certificate of achievement. This prestigious certificate, endorsed by the Quality Licence Scheme, will be titled 'Diploma in Accounting and Finance at QLS Level 4'. Your certificate will be delivered directly to your home. The pricing scheme for the certificate is as follows: * £89 GBP for addresses within the UK. Please note that delivery within the UK is free of charge. Please Note: NextGen Learning is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. CPD 120 CPD hours / points Accredited by CPD Quality Standards MODULE 01: AN OVERVIEW OF ACCOUNTING FUNDAMENTALS 08:24 * 1: Introduction to Accounting Preview 08:24 MODULE 02: EXPLORING THE RESPONSIBILITIES OF ACCOUNTANTS 09:04 * 2: The Role of an Accountant 09:04 MODULE 03: UNDERSTANDING THE PRINCIPLES AND STANDARDS OF ACCOUNTING 12:05 * 3: Accounting Concepts and Standards 12:05 MODULE 04: METHOD OF RECORDING FINANCIAL TRANSACTIONS 11:01 * 4: Double-Entry Bookkeeping 11:01 MODULE 05: BALANCE SHEET: ANALYZING A SNAPSHOT OF A COMPANY'S FINANCIAL POSITION 11:16 * 5: Balance Sheet 11:16 MODULE 06: INCOME STATEMENT - SUMMARY OF A COMPANY'S REVENUES AND EXPENSES 10:05 * 6: Income statement 10:05 MODULE 07: DIFFERENT TYPES OF FINANCIAL STATEMENTS 12:52 * 7: Financial Statements 12:52 MODULE 08: INFLOW AND OUTFLOW OF CASH IN A BUSINESS 09:19 * 8: Cash Flow Statements 09:19 MODULE 09: PROFIT AND LOSS STATEMENT - REVENUES, EXPENSES, AND PROFITABILITY 09:19 * 9: Understanding Profit and Loss Statement 09:19 MODULE 10: FINANCIAL BUDGETS AND PLANS 14:21 * 10: Financial Budgeting and Planning 14:21 MODULE 11: AUDITING - ENSURING ACCURATE FINANCIAL INFORMATION 08:29 * 11: Auditing 08:29 ORDER YOUR CPD QUALITY STANDARD CERTIFICATE (OPTIONAL) 01:00 * 12: CPD Quality Standard Certificate (Optional) 01:00 PDF ORDER YOUR QLS ENDORSED CERTIFICATE (OPTIONAL) 01:00 * 13: QLS Endorsed Certificate (Optional) 01:00 PDF WHO IS THIS COURSE FOR? This Accounting and Finance Course is suitable for anyone interested in the following: * Accounts Assistant * Accounts Payable & Expenses Supervisor * Accounts Payable Clerk * Audit Trainee * Payroll Administrator / Supervisor * Tax Assistant / Accountant * Accounting Clerk * Auditing Clerk * Accounts Receivable Clerk After Completing this Accounting and Finance ( Financial Planning & FInancial Analysis) course, anyone can later enrol in the following course: * Association of Chartered Certified Accountants (ACCA) * AAT Level 2 Certificate in Accounting * BCS Foundation Certificate in Business Analysis * AAT Level 3 Diploma in Accounting * AAT Level 1 Award in Bookkeeping * A-level Accounting * Certificate in Business Accounting (CBA) * IGCSE Accounting * Foundation in Bookkeeping Diploma * Level 7 Diploma in Accounting and Finance * Association of Accounting Technicians * Certificate in Business Accounting CBA * AAT Level 2 Certificate in Accounting * AAT Foundation Certificate in Bookkeeping Level 2 * ACCA Diploma in Accounting and Business (RQF Level 4) * CIMA Certificate in Business and Accounting * CIMA Diploma in Management Accounting * AAT Advanced Diploma in Accounting Level 3 Official Xero Certification * Level 6 Diploma in Professional Accountancy (RQF) * AAT Level 4 Diploma in Professional Accounting * Level 3 Diploma Foundation Diploma in Accountancy * AAT Advanced Certificate in Bookkeeping Level 3 * AAT Level 2 Certificate in Bookkeeping * Chartered Institute of Management Accountants * Institute of Financial Accountants * Membership of the Chartered Institute of Management Accountants * Level 4 Diploma Accounting and Business Finance * NCFE Level 3 Diploma in Skills for Business: Finance REQUIREMENTS You are cordially invited to enroll in this course; please note that there are no formal prerequisites or qualifications required. We've designed this curriculum to be accessible to all, irrespective of prior experience or educational background. CAREER PATH The aim of this exclusive Accounting and Finance course is to help you toward your dream career. Like as: * Accounting Managers * Accountants * Bankers * Finance Officer * Payroll Officer * Bookkeeper * Finance Administrator You might earn anything between £30,000 and £80,000 annually in the UK, depending on your profession. CERTIFICATES CPD QUALITY STANDARD CERTIFICATE Digital certificate - £4.99 HARDCOPY CERTIFICATE (FREE UK DELIVERY) Hard copy certificate - £9.99 Hardcopy Transcript: £9.99

Sage 50 Accounts

By Xpert Learning

ABOUT COURSE SAGE 50 ACCOUNTS: MASTER THE POPULAR ACCOUNTING SOFTWARE Learn how to use Sage 50 Accounts, one of the most popular accounting software solutions available, with this comprehensive online course. This course is designed for everyone, from beginners to experienced professionals. You will learn everything you need to know to use Sage 50 Accounts effectively, from setting up a new company to creating year-end reports. The course is taught by industry experts and covers a wide range of topics, including: * Setting up and managing a company * Recording transactions * Payroll processing * Creating reports * Tax compliance You will learn through a combination of video lessons, interactive exercises, and self-paced assessments. By the end of the course, you will be able to: * Use Sage 50 Accounts to manage all aspects of your accounting * Create accurate and timely financial reports * Comply with all relevant tax regulations Why study this course? * Sage 50 Accounts is a powerful accounting software solution used by millions of businesses worldwide. * Learning how to use Sage 50 Accounts can help you to save time and improve the efficiency of your accounting processes. * Sage 50 Accounts is a highly sought-after skill by employers. This course is perfect for: * Small business owners * Bookkeepers and accountants * Anyone who wants to learn a new accounting skill Enroll today and start your journey to becoming a Sage 50 Accounts expert! Course features: * Taught by industry expert * Comprehensive coverage of all aspects of Sage 50 Accounts * Interactive exercises and self-paced assessments Requirements: For practice purposes, you should have Sage 50 Software installed on your PC. The software is not included with this course. WHAT WILL YOU LEARN? * Use Sage 50 Accounts to manage all aspects of your accounting * Create accurate and timely financial reports * Comply with all relevant tax regulations COURSE CONTENT GETTING STARTED * GETTING STARTED SETTING UP OF THE SYSTEM * VIRTUAL TOUR OF SAGE 50CLOUD ACCOUNTS * EDIT AND MODIFY DEFAULT CHART OF ACCOUNTS * ADD A BUSINESS BANK ACCOUNT, CREDIT CARD ACCOUNT AND PETTY CASH ACCOUNT * CREATING AND DELETING DEPARTMENTS CUSTOMERS AND SUPPLIERS * SETTING UP CUSTOMERS AND SUPPLIERS * CREATE A PROJECT LIST * ENTERING PURCHASE (SUPPLIER INVOICE), PURCHASE CREDIT NOTE, PURCHASE ORDER.. * ENTERING SALES FIXED ASSETS * FIXED ASSET REGISTER BANK PAYMENTS AND RECEIPTS * BANK PAYMENTS AND TRANSFER * RECORDING CUSTOMER RECEIPTS AND SUPPLIER PAYMENTS * ADDING RECURRING ITEMS PETTY CASH * PETTY CASH ACCOUNT BANK RECONCILIATION WITH BANK FEED * BANK RECONCILIATION - CURRENT ACCOUNT * BANK RECONCILIATION - PETTY CASH AND CREDIT CARD AGED REPORTS * AGED REPORTS PAYROLL JOURNALS * PAYROLL POSTING AND PAYROLL JOURNAL VAT RETURN (MAKING TAX DIGITAL) * VAT RETURN OPENING BALANCES ON SAGE 50 CLOUD ACCOUNTS * OPENING BALANCES ON SAGE 50 YEAR END JOURNALS * YEAR END JOURNALS CASH FLOW, BUDGETS AND ACCOUNTANT'S REPORT * CASH FLOW, BUDGETS AND ACCOUNTANT'S REPORTS APPS AND ADD-ONS * APPS AND ADD-ONS CORRECTION OF ERROR, BACKUP AND RESTORE * CORRECTION OF ERROR, BACK UP AND RESTORE COURSE BOOK * COURSEBOOK FOR SAGE 50 CLOUD ACCOUNTS (V.29) - 2023 A course by Ujjwala D'Souza MAAT, Sage/Xero/Quickbooks Trainer/Advisor RequirementsFor practice purposes, you should have Sage 50 Software installed on your PC. The software is not included with this course. Audience Small business owners Bookkeepers and accountants Anyone who wants to learn a new accounting skill AUDIENCE * Small business owners * Bookkeepers and accountants * Anyone who wants to learn a new accounting skill

Advanced Xero Accounting Course

By Xpert Learning

ABOUT COURSE Why should you enrol in the course? Xero is a cloud-based accounting software that is used by businesses of all sizes around the world. It is a powerful and easy-to-use tool that can help you to manage your finances more effectively. This online course will teach you everything you need to know about how to use Xero. You will learn how to set up your account, enter transactions, generate reports, and more. Whether you are a business owner, bookkeeper, or accountant, this course is for you. Learning outcomes of the course By the end of this course, you will be able to: * Set up and manage a Xero account * Enter transactions, including sales, purchases, and expenses * Generate financial reports, such as profit and loss statements, balance sheets, and cash flow statements * Reconcile bank accounts * Process payroll * File VAT returns * Use advanced features of Xero, such as multi-currency and project tracking Target audience This course is ideal for: * Business owners * Bookkeepers * Accountants * Anyone who wants to learn how to use Xero Requirements for the course * No prior experience with Xero is required * Access to a computer with an internet connection Curriculum The course is divided into three levels: * Beginner * Intermediate * Advanced The beginner level covers the basics of using Xero, such as setting up an account, entering transactions, and generating reports. The intermediate level covers more advanced topics, such as bank reconciliation, payroll, and VAT returns. The advanced level covers even more advanced topics, such as multi-currency and project tracking. Conclusion This online course is a comprehensive and easy-to-follow guide to using Xero. Whether you are a beginner or an experienced user, you will learn something new from this course. If you are interested in learning how to use Xero, I encourage you to enrol in this course today. WHAT WILL YOU LEARN? * Set up and manage a Xero account * Enter transactions, including sales, purchases, and expenses * Generate financial reports, such as profit and loss statements, balance sheets, and cash flow statements * Reconcile bank accounts * Process payroll * File VAT returns * Use advanced features of Xero, such as multi-currency and project tracking COURSE CONTENT GETTING STARTED * SETTING UP XERO * HOW TO ACTIVATE BANK FEED ON XERO SETTING UP OF THE SYSTEM * VIRTUAL TOUR OF XERO * ADDING A BUSINESS BANK ACCOUNTS AND CASH ACCOUNTS ON XERO * CHART OF ACCOUNTS AND CONVERSION BALANCES * CREATING/DELETING (TRACKING CATEGORIES) CUSTOMERS AND SUPPLIERS * SETTING UP CUSTOMER AND SUPPLIER * CREATE A PROJECT * ENTERING PURCHASE (SUPPLIER INVOICES), PURCHASE CREDIT NOTES, PURCHASE ORDERS * ENTERING SALES (CUSTOMER INVOICE), SALES CREDIT NOTES, QUOTES FIXED ASSETS * ENTERING FIXED ASSETS * INVENTORY BANK PAYMENTS AND RECEIPTS * BANK FEED OR IMPORT A STATEMENT * ENTERING BANK PAYMENT AND BANK RECEIPTS * INTERNAL BANK TRANSFER * REPEATING BILL * CASH CODING PETTY CASH * PETTY CASH BANK RECONCILIATION * BANK RECONCILIATION BUSINESS CREDIT CARD * BUSINESS CREDIT CARD AGED REPORTS * AGED REPORTS PAYROLL * PAYROLL VAT RETURN * VAT RETURN CIS RETURN * CIS RETURN ACCRUAL AND PREPAYMENT * ACCRUAL AND PREPAYMENT ACCRUED INCOME AND DEFERRED INCOME * ACCRUED INCOME AND DEFERRED INCOME DEPRECIATION JOURNAL * DEPRECIATION JOURNAL MANAGEMENT REPORTS * MANAGEMENT REPORTS PREPARATION OF BUDGET * PREPARATION OF BUDGET CASH FLOW * CASH FLOW PAYMENT SERVICES ON XERO * PAYMENT SERVICES ON XERO BANK RULES * BANK RULES MULTICURRENCY ON XERO * MULTICURRENCY ON XERO APP MARKETPLACE * APP MARKETPLACE INTRODUCTION OF RESOURCES DURING COVID-19 * INTRODUCTION OF RESOURCES DURING COVID-19 CORRECTION OF ERRORS * CORRECTION OF ERRORS A course by Ujjwala D'Souza MAAT, Sage/Xero/Quickbooks Trainer/Advisor Material Includes Course Videos Coursebook RequirementsNo prior experience with Xero is requiredAccess to a computer with an internet connection Audience Business owners Bookkeepers Accountants Anyone who wants to learn how to use Xero REQUIREMENTS * No prior experience with Xero is required * Access to a computer with an internet connection

Business Finance 101

By Ideas Into Action

Business Finance 101: A Beginner’s Guide to Business Accounting and Finance Course Description Course Description Three are three main reasons for business failure – an under-skilled management team; ineffective marketing; and poor financial management. Every manager, or student of management, requires a good grasp of business finance. This course will help. Business finance concerns the management of the monetary resources of an organisation. There are two aspects to this: 1. Raising the money to invest in the business 2. Managing that investment properly to generate a return Raising the money is about having an attractive proposition and managing the risk to investors. Managing the investment is about the financial controls and reporting of the business. This course covers the three main financial reports; financial performance indicators; and investment analysis. This course will give you a good grasp of the key principles and issues in business finance. Key Learning Participants in this course will learn: * The history of business accounting * Why businesses fail * The two main purposes of business finance and accounting * The key principles of business finance and what they mean * What debits and credits are * The three key financial statements for an organisation * What the Balance Sheet tells you * What the Income Statement (also called the Profit and Loss Account) tells you * What the Cashflow Statement tells you * Key financial performance indicators in business * Analysing business investments Curriculum L1 What is business finance? L2 Why businesses fail L3 The Principles of Business Finance Part 1 L4 The Principles of Business Finance Part 2 L5 The Balance Sheet L6 The Income Statement L7 The Cashflow Statement L8 A Business Finance Exercise L9 Financial Performance Indicators L10 Investment Analysis L11 Investment Analysis Exercise L12 Key Learning Points in Business Finance Pre-Course Requirements None Additional Resources None Course Tutor Your tutor is Ross Maynard. Ross is a Fellow of the Chartered Institute of Management Accountants in the UK and has 30 years’ experience as a process improvement consultant specialising in business processes and organisation development. Ross is also a professional author of online training courses. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

Finance for the non-accountant (In-House)

By The In House Training Company

No-one in business will succeed if they are not financially literate - and no business will succeed without financially-literate people. This is the ideal programme for managers and others who don't have a financial qualification or background but who nonetheless need a greater understanding of the financial management disciplines essential to your organisation. This course will give the participants a sound understanding of financial reports, measures and techniques to make them even more effective in their roles. It will enable participants to: * Overcome the barrier of the accountants' strange language * Deal confidently with financial colleagues * Improve their understanding of your organisation's finance function * Radically improve their planning and budgeting skills * Be much more aware of the impact of their decisions on the profitability of your organisation * Enhance their role in the organisation * Boost their confidence and career development 1 REVIEW OF THE PRINCIPAL FINANCIAL STATEMENTS * What each statement contains * Outline * Detail * Not just what the statements contain but what they mean * Balance sheets and P&L accounts (income statements) * Cash flow statements * Detailed terminology and interpretation * Types of fixed asset - tangible, etc. * Working capital, equity, gearing 2 THE 'RULES' - ACCOUNTING STANDARDS, CONCEPTS AND CONVENTIONS * Fundamental or 'bedrock' accounting concepts * Detailed accounting concepts and conventions * What depreciation means * The importance of stock, inventory and work in progress values * Accounting policies that most affect reporting and results * The importance of accounting standards and IFRS 3 WHERE THE FIGURES COME FROM * Accounting records * Assets / liabilities, Income / expenditure * General / nominal ledgers * Need for internal controls * 'Sarbox' and related issues 4 MANAGING THE BUDGET PROCESS * Have clear objectives, remit, responsibilities and time schedule * The business plan * Links with corporate strategy * The budget cycle * Links with company culture * Budgeting methods * 'New' budgeting * Zero-based budgets * Reviewing budgets * Responding to the figures * The need for appropriate accounting and reporting systems 5 WHAT ARE COSTS? HOW TO ACCOUNT FOR THEM * Cost definitions * Full / absorption costing * Overheads - overhead allocation or absorption * Activity based costing * Marginal costing / break-even - use in planning 6 WHO DOES WHAT? A REVIEW OF WHAT DIFFERENT TYPES OF ACCOUNTANT DO * Financial accounting * Management accounting * Treasury function * Activities and terms 7 HOW THE STATEMENTS CAN BE INTERPRETED * What published accounts contain * Analytical review (ratio analysis) * Return on capital employed, margins and profitability * Making assets work - asset turnover * Fixed assets, debtor, stock turnover * Responding to figures * EBIT, EBITEDIA, eps and other analysts' measure 8 OTHER KEY ISSUES * Creative accounting * Accounting for groups * Intangible assets - brand names * Company valuations * Fixed assets / leased assets / off-balance sheet finance

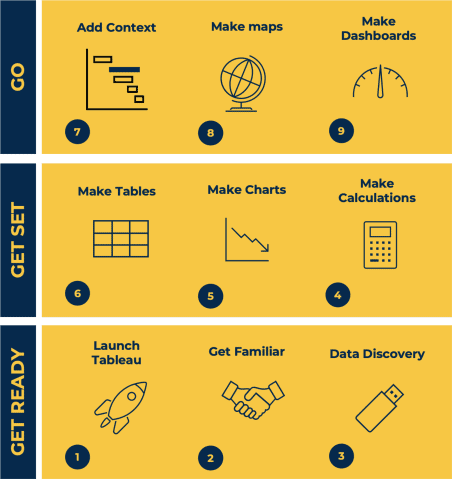

Tableau Desktop Training - Foundation

By Tableau Training Uk

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. -------------------------------------------------------------------------------- For Private options, online or in-person, please send us details of your requirements: -------------------------------------------------------------------------------- This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. -------------------------------------------------------------------------------- THE COURSE IS SPLIT INTO 3 PHASES AND 9 MODULES: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU * Check Install & Setup * Why is Visual Analytics Important MODULE 2: GET FAMILIAR * What is possible * How does Tableau deal with data * Know your way around * How do we format charts * Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY * Connecting to and setting up data in Tableau * How Do I Explore my Data – Filters & Sorting * How Do I Structure my Data – Groups & Hierarchies, Visual Groups * How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates PHASE 2: GET SET MODULE 4: MAKE CALCULATIONS * How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS * Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots * Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES * Creating Tables – Creating Tables, Highlight Tables, Heat Maps PHASE 3: GO MODULE 7: ADD CONTEXT * Reference Lines and Bands MODULE 8: MAKE MAPS * Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS * Using the Dashboard Interface * Dashboard Actions -------------------------------------------------------------------------------- This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. -------------------------------------------------------------------------------- WHAT PEOPLE ARE SAYING ABOUT THIS COURSE “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.” Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.” Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.” Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.” Matthew H., ISS Group

Ethics Matters: Corporate Governance and CFOs

By FD Capital

Ethics Matters: Corporate Governance and CFOs,” the podcast where we dive deep into the critical intersection of corporate governance. -------------------------------------------------------------------------------- Sustainability and ESG reporting have gained significant attention in recent years. How do CFOs incorporate these considerations into their financial strategies and decision-making? CFOs recognise that sustainable practices and ESG considerations are not only ethical imperatives but also critical for long-term business success. We incorporate these considerations into financial strategies by assessing the environmental and social impacts of our operations, supply chains, and investment decisions. By incorporating ESG factors into our financial analyses, we make more informed decisions that align with our company’s values and stakeholder expectations. Furthermore, CFOs play a pivotal role in ESG reporting. We collaborate with cross-functional teams to collect relevant data, establish reporting frameworks, and communicate the company’s sustainability initiatives to stakeholders. This transparency fosters trust and accountability while allowing investors, customers, and the broader community to evaluate our commitment to sustainable practices. Board engagement is essential for effective corporate governance. How can CFOs contribute to building a strong relationship between the CFO and the board of directors? Building a strong relationship with the board of directors begins with open and transparent communication. CFOs provide timely and accurate financial information, strategic insights, and risk assessments to the board. We actively participate in board meetings, present financial reports, and engage in discussions about financial performance, strategic initiatives, and potential risks. By demonstrating our financial expertise and ethical leadership, we contribute to a healthy and productive relationship with the board. It’s also crucial for CFOs to provide independent perspectives and challenge conventional thinking when necessary. By offering well-informed insights and raising critical questions, we contribute to robust board discussions and decision-making. This collaborative approach fosters an environment where diverse perspectives are valued, and ethical considerations are thoroughly examined. I would encourage fellow CFOs to prioritise ethics and corporate governance as integral components of their roles. Embed ethical considerations into decision-making processes, ensure robust governance structures, and actively engage with stakeholders. By doing so, we can drive sustainable, responsible, and successful organizations. https://www.fdcapital.co.uk/podcast/ethics-matters-corporate-governance-and-cfos/ [https://www.fdcapital.co.uk/podcast/ethics-matters-corporate-governance-and-cfos/] -------------------------------------------------------------------------------- TAGS * Online Events [https://www.eventbrite.co.uk/d/online/events/] * Things To Do Online [https://www.eventbrite.co.uk/ttd/online/] * Online Conferences [https://www.eventbrite.co.uk/d/online/conferences/] * Online Business Conferences [https://www.eventbrite.co.uk/d/online/business--conferences/] * #event [https://www.eventbrite.co.uk/d/online/%23event/] * #ethics [https://www.eventbrite.co.uk/d/online/%23ethics/] * #matters [https://www.eventbrite.co.uk/d/online/%23matters/] * #cfos [https://www.eventbrite.co.uk/d/online/%23cfos/] * #corporategovernance [https://www.eventbrite.co.uk/d/online/%23corporategovernance/]

Educators matching "Financial Reporting"

Show all 99Search By Location

- Financial Reporting Courses in London

- Financial Reporting Courses in Birmingham

- Financial Reporting Courses in Glasgow

- Financial Reporting Courses in Liverpool

- Financial Reporting Courses in Bristol

- Financial Reporting Courses in Manchester

- Financial Reporting Courses in Sheffield

- Financial Reporting Courses in Leeds

- Financial Reporting Courses in Edinburgh

- Financial Reporting Courses in Leicester

- Financial Reporting Courses in Coventry

- Financial Reporting Courses in Bradford

- Financial Reporting Courses in Cardiff

- Financial Reporting Courses in Belfast

- Financial Reporting Courses in Nottingham